Some Known Facts About Corporate Financial Health Analysis.

The Ultimate Guide To Irs Tax Notifications

Table of ContentsThe 5-Minute Rule for Irs Unpaid Back Taxes7 Simple Techniques For Delinquent Federal TaxesA Biased View of Protecting Assets After AssessmentThe Ultimate Guide To Audit Protection Annual PlansHow Accounting / Bookkeeping can Save You Time, Stress, and Money.Irs Partial Payment Installment Agreement for Beginners

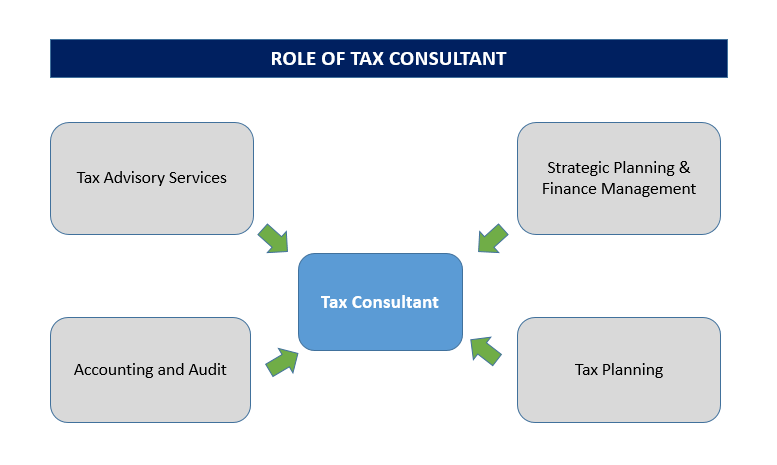

Often credited to Ben Franklin is this well-known quote:"Absolutely nothing is certain other than for fatality and taxes." Many individuals discover tax obligation issues to be confusing and difficult, as well as, instead of doing their very own taxes, they often choose to hire an expert (Late or Unfiled IRS Tax Returns). Taxpayers who have substantial properties or complex personal financial resources, may opt to collaborate with a tax expert, who can utilize her comprehensive knowledge and also experience to minimize her customers' tax responsibilities and also protect their interests.Tax laws transform frequently, as well as lots of individuals as well as organization owners are merely not aware of the myriad of policies that regulate deductions, credits and also reportable earnings. Consequently, the typical taxpayer may make mistakes that can cause the underpayment or over repayment of tax obligations. If the taxpayer underpays his taxes, he might undergo an IRS audit, with possible charges.

A tax working as a consultant is a service that gives experienced recommendations to tax filers. A great tax obligation consultant recognizes tax obligation legislations, and also is able to recommend techniques that reduce obligations while likewise lowering the chance of an audit that could bring about a dispute with the internal revenue service or with a state tax obligation agency.

Our Irs Collections Representation Statements

A tax preparer is someone who prepares revenue tax return, such as the 1040 or 1040 EZ, for others. The trade is loosely regulated: tax preparers usually finish a short training program, register with the IRS to receive a tax obligation preparer number, as well as, in some states, must sign up with the state agency prior to beginning job. his comment is here.

Assisting customers with tax obligation issues during and after a significant life change, such as a marriage, separation, fatality of a spouse or birth of a child. Completing intricate tax return and also timetables that a lot of tax obligation preparers are not familiar with. Representing a customer in ventures with the IRS or various other tax obligation collection agencies.

Right here are some common requirements for ending up being a tax obligation expert: Becoming a tax obligation preparer usually only calls for finishing a brief training program. Some states, such as California, require tax preparers to complete a course authorized by the governing company that registers or certifies preparers. People that want a job as a tax expert should ask their state's governing body to provide them with a list of authorized program service providers (try this).

Corporate Tax Payment Agreements Can Be Fun For Everyone

Programs funded by private firms might view be for free or require just the acquisition of some books. In most cases, people who succeed in these training courses might be used employment by the tax prep firm. Another choice for those that have an interest in tax obligation prep work as a profession is to end up being an IRS Tax Volunteer.